Biography

Interests

Mende Mensa Sorato1*, Akbar Abdollahi Asl2 & Majid Davari3

1B.Pharm, MSc. PhD Scholar at Tehran University of Medical Sciences, Faculty of Pharmacy, Department of

Pharmacoeconomics and pharmaceutical Administration

2PharmD, PhD in Pharmacoeconomics, Tehran University of Medical Sciences, Faculty of Pharmacy, Department

of Pharmacoeconomics and pharmaceutical Administration

3PharmD, PhD in Health/Pharmacoeconomics, Tehran University of Medical Sciences, Faculty of Pharmacy,

Department of Pharmacoeconomics and pharmaceutical Administration

*Correspondence to: Dr. Mende Mensa Sorato, B.Pharm, MSc. PhD scholar at Tehran University of Medical Sciences, Faculty of Pharmacy, Department of Pharmacoeconomics and pharmaceutical Administration.

Copyright © 2019 Dr. Mende Mensa Sorato, et al. This is an open access article distributed under the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Abstract

Aligning around a single set of global standards can support processes and capabilities that create

value for all participants in a supply chain, from business partners down to the patients. Serialization

being a new concept very little is known about its impact on domestic producers in developing

countries.

To identify the bottom line impact of applying global serialization standard on young domestic

pharmaceutical production companies in developing countries.

We have reviewed available literatures, directives, guidelines and manuals of different countries,

conference proceedings and reports available online.

Being a new technology we couldn’t find enough evidence to show the clear impact of global

GS1 serialization in domestic producers of developing countries. Based on our review domestic

producers in low and middle income countries should evaluate their capacity before implementing

the global standards in their immature industries. Therefore, it is worth to improve the countries

border control, transparency of supply chain and national drug quality control laboratory capacity

for their domestic production and designing their own supply chain visibility system to address the

imported products based on their own capacity than struggling with global serialization system is

imperative. GS1 serialization should be considered in strategic plans of all pharmaceutical supply

systems in these countries. This is because the future distribution will be based on the Global

standards as diffusion in technology and human capacity development in the area improves.

Introduction

Maintaining the supply chain integrity of pharmaceuticals is vital for ensuring quality of healthcare delivery.

Drugs are indispensable components of healthcare delivery. Substandard and counterfeit medicines are

challenges of 21st healthcare system with estimated prevalence of 20-40% in developing countries and

about 1% in developed countries. This is because development and transportation of drugs is complex and

involving multinational companies and borders of different countries. A single pill might pass through a

dozen countries during its manufacturing process, which offers many opportunities for criminals to put fake

drugs into the supply chain. For example, chemicals synthesized in China can be combined with fillers in

India and then packaged in Mexico before arriving at a pharmacy in Canada and may be used by Ethiopian

who has requested his friend in Canada to buy the drug for his illness due absence of the drug in Ethiopia

[1].

In addition to this complex nature, drug trafficking is highly lucrative business and smugglers are financially and technically well equipped to extent that there is no system to break their extensive international networks. Weakness of the pharmaceutical regulatory system in developing countries, shortage of essential drugs, unaffordability, leaky supply chain systems and community awareness are fuels for increased counterfeiting and smuggling in Developing countries. While in developed countries, e-commerce and long handed smugglers network are contributing to the problem. Therefore, it is important to secure and protect these more complex and interconnected global pharmaceutical distribution networks [2].

Tracking and tracing of products in supply chain is designed to prevent the manufacture and sale of the counterfeit medicines, implement a system to detect any such product that is the supply chain already and respond quickly to any incidents to make sure the patients are safe and the supply chain is clean [1,2].

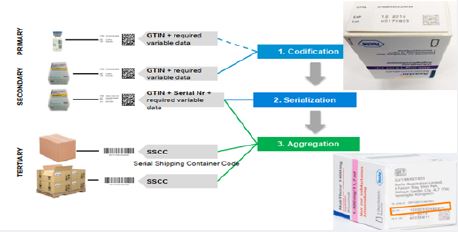

Serialization is the process by which products are marked with a unique identifier typically a unique number or alphanumeric code and is beginning to be leveraged to enhance supply chain security. The unique serial number, along with other related information, is typically encoded in a barcode that can be read electronically. Serialization itself provides virtually no benefit to the supply chain; rather it is the use of that serialized data in a traceability system that enhances supply chain security. The infrastructure and processes that leverage serialized data in some manner to improve supply chain security are collectively referred to as a “traceability” or “track and trace” system [3].

Aggregation is tracking of parent/child relationships from unit level to case, and case to pallet.it is important because wholesalers and third-party logistics providers (3PL) need the capability to infer contents of pallets and cases to conduct their business efficiently, they are requiring serialized product to be aggregated. Without aggregation and inference, wholesalers and 3PLs would need to break down all packaging levels to the smallest saleable unit to determine which unit-level serial numbers are involved in a transaction. Therefore, aggregation is required by many trading partners and is becoming the industry standard [4].

Although serialization requires large investments of time and resources, with the appropriate infrastructure and technology, the data acquired from serialized product can be leveraged to address challenges that countries face, such as counterfeiting and diversion, by increasing visibility and control in the supply chain. Further, knowledge of product location and product owners throughout the supply chain can help identify where an illegitimate product entered the legitimate supply chain or can allow for more precise and rapid recall of pharmaceutical products if necessary [5,6].

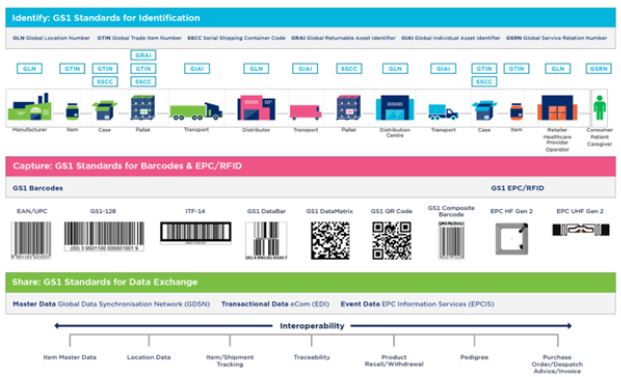

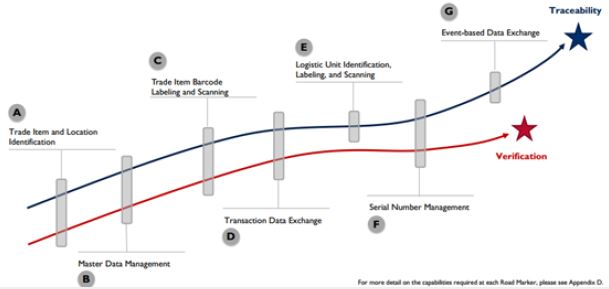

GS1 standards enable traceability of items in the supply chain: Low-precision identification; Mediumprecision

identification; High-precision identification; Item exists in multiple locations at the same time;

Item exists in only one location at the same time; Enables inventory control; Enables anti-substandard

and falsified (SF) measures and Enables product recall [7]. The GS1 system of standards is such a system,

providing a comprehensive platform for companies to identify products and business entities, capture supply

chain data, and share data with trading partners. GS1 standards encompass identification standards, data

standards, and automatic identification data capture (AIDC) standards such as barcodes. Figure 1 below

summarizes some of the GS1 standards that support supply chain management and data visibility [7].

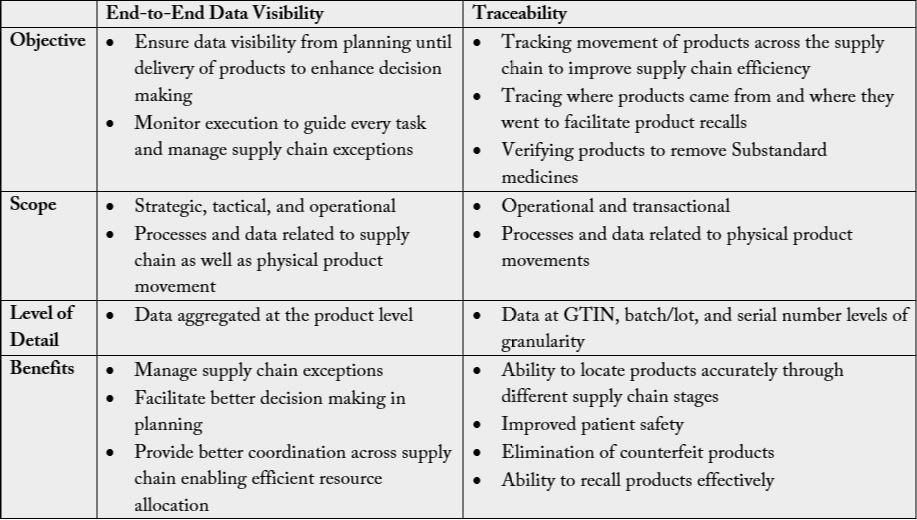

Both traceability and end-to-end visibility are two faces of one coin in maintaining supply chain security.

The main objective of traceability is to track movement of products across the supply chain to improve

supply chain efficiency and verify products to remove Substandard and Falsified medicines and improve

patient safety Scope While the objective of end-to-end visibility is to Ensure data visibility from planning

until delivery of products/commodities to enhance decision making and Monitor execution to guide every

task and manage supply chain exceptions (Table 1) [7].

A serialization investment can deliver numerous benefits for manufacturers. Beyond compliance with the

federal government, serialization helps protect consumer safety through proper labeling management of

packaging processes hence reduce risk of counterfeiting. This can help protect brand reputation by increasing

patient safety. With serialization, manufacturers can capture necessary information while a product moves

through the supply chain. This enables them to improve efficiency, control costs, and increase shipping

accuracy, ensuring recall integrity. When a company has an understanding of the supply chain process, it

can more easily control inventory and drive better understanding of the impact of disruptions. Additionally,

serialization helps companies minimize chargebacks associated with packaging errors and claims against

pharmaceutical manufacturers (Table 2) [7].

Aligning around a single set of global standards can support processes and capabilities that create value for

all participants in a supply chain, from business partners down to the patient. Advantages of fully functioning

end-to-end serialization in healthcare include the following [7-10].

Increasing data visibility can strengthen the supply chain in several ways:

• Improve visibility of product “status” (e.g., expired or about to expire product, recalled product)

• Improve product quality management (e.g., expired and/or recalled products are promptly identified)

• Provide visibility of where the product is within the supply chain

• Reduce data management costs

• Support systems interoperability, allowing access to linked data through identification keys across logistics,

clinical services, insurance, and patient applications

Patient safety issues can be addressed through the use of standardized information to:

• Enable medication authentication to remove falsified or stolen product from reaching patients

• Improve recall management effectiveness, reducing the risk of patient harm

• Reduce drug shortages

• Improve pharmacovigilance

• Reduce medication errors, such as inaccurate administration, through bedside scanning

Global supply chains, including for health commodities, face high security risks due to their complexity and

global reach. Reporting movement of products through the supply chain, whether at the batch or unique

item level, is important for security management and can allow protection against various threats, including:

• Falsified products

• Theft or diversion of products

• Reimbursement fraud

The increased data quality from automatic and standardized data capture allows for the following benefits:

• Reduced manual processes in data capture for receiving, inventory management, picking, packing, and

dispatching

• Improved ability to capture consumption data, resulting in better informed demand forecasting and

inventory planning and reduced inventory management costs

• Improved efficiency and cost of “reverse” logistics processes (e.g., those used for returns, recalls)

• Improved efficiency of payment and payment monitoring processes

• Harmonized trade/customs clearance procedures

Countries’ use of their own proprietary identifiers and national/domestic labeling requirements results in

higher costs for manufacturers and limits their flexibility to produce larger batch runs to serve orders from

multiple markets. Standardized identification and labeling can eliminate this trade barrier by enabling

products to be identifiable globally. For domestic manufacturers, use of global standards also increases their

ability to compete in other markets.

Tracking and Tracing System

There are three underpinnings, which are implemented in various ways, in various forms in the U.S. and in

other countries [7,11].

(Unique product via its product identity, Lot number and Expiration date).

(tracking a forward view where is a product right now in the supply chain and capturing information about

that product as it moves through the supply chain. Tracing is more of a historical view let me see where the

product has been or who has owned it).

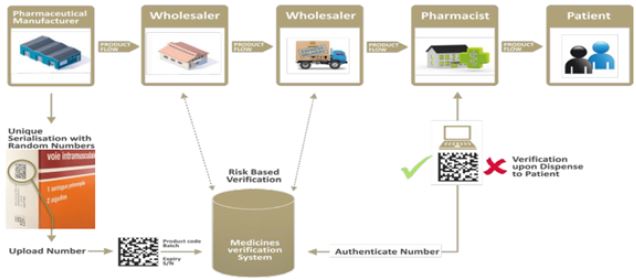

Product verification refers to checking at any single point in the supply chain that the unique identifier

printed on the item is assigned by the product manufacturer. Countries can implement verification as part of

a traceability mandate or as a point-of-dispense (e.g., check at a service delivery point) and/or point-of-use

(e.g., check by the consumer or the patient) model at an end point in the supply chain (Figure 2).

Verification requires, at a minimum, that trading partners at the end of the trade item supply chain check the validity of a trade item’s unique identifier and update its status (e.g., decommissioned). The common models for verification are defined by the point at which the verification occurs, generally either at the point-of-use (Before use of a product by a patient or consumer, the unique identifier on a product’s packaging is validated by comparing it with information provided by the product manufacturer) or at Point of dispense (Before dispense in health centers, pharmacies, or health posts, the unique identifier on a product’s packaging is validated by comparing it with information provided by the product manufacturer) [7].

Road of tracking and tracing system involves series of components like: Assigning Trade item and location

identification, master data management, Trade item barcoding and scanning, Transaction data exchange,

Logistic unit identification labeling and scanning, Serial number management and Event-based data

exchange (Figure 3) [7,12,13].

Unique identification of trade items and locations/legal entities is a foundational requirement for verification

and traceability as a means to access master, transaction, and event information about items and locations

in the supply chain and to share this information with internal and external trading partners. The use of

global identification keys like the Global Trade item number/GTIN and Global Location number/GLN

by all trading partners facilitates the exchange of information, increasing supply chain data visibility. Helps

to ensure that products have a globally unique identification number assigned to them; provide product

movement clarity along the entire supply chain and serves as the foundation for procurement accuracy, Good

Distribution Practices (GDP), inventory management, verification, and traceability. However, it doesn’t feet

National coding structures specific countries [7].

Master data management (MDM) is the process of linking identification data and reference data across

multiple systems into a single, consistent point of reference. Master data refers to data that is associated

with the product and mostly remains unchanged, e.g. the product description. Global data synchronization enables healthcare trading partners to share trusted product master data, locally and globally, in an automatic

and efficient way. These data are foundational for all items and locations to be used across supply chain

business functions, from registration and importation to service delivery. Treating MDM like an information

technology project rather than a business strategy that is optimized with appropriate use of enabling

technologies is its potential challenge [7,12].

Barcodes are symbols that can be scanned electronically using laser or camera-based technologies to

automatically capture data encoded in the barcode and input it into relevant supply chain information

systems, e.g., enterprise resource planning, warehouse management system (WMS), and LMIS. Barcodes

play a key role in supply chains, enabling parties like retailers, manufacturers, transport providers, and

hospitals to automatically identify and track products as they move through the supply chain. Trade item

packages should be labeled with a barcode with a minimal set of key data elements like the GTIN, batch/lot,

and expiry date to ensure that these data can be captured and referenced at every point in the supply chain,

through to the point of dispense. By scanning the GTIN, the user can also access other item master data

stored within a given database. However, developing proprietary barcode labeling is redundant and creates

challenges to interoperability and future standards implementation and including more data in the barcode

than what is required to enable traceability increases costs for trading partners in applying and using that

information [12].

Transaction data are any data derived from transactions, such as a requisition order (RO), purchase order

(PO), advance ship notice (ASN), stock count, distribution order (DO), or invoice. These are data that is

shared between two trading partners in the sale/purchase process (Electronic Data Interchange), e.g. purchase

order, delivery note, invoice, payment. Leveraging standards for transaction data exchange is important to

enable automation of common business transactions commonly occurring across the supply chain in support

of data accuracy and process efficiency. Potential Pitfall this data is scaling too quickly before protocols have

been defined and tested with multiple types of trading partners and systems [7,13].

A logistic unit is an item of any composition established for transport and/or storage that needs to be

managed throughout the supply chain, for example, a case, pallet or parcel. The serial shipping container

code (SSCC) is a unique serialized number assigned by and labeled on the package by the creator of

the logistic unit. SSCCs are matched with the electronic business messages that refer to them, such as

packing slips and advanced ship notices (ASNs), to track them individually to support order and delivery

tracking, automated goods receiving, and as a reference number to provide detailed information on the

contents of a given unit. The SSCC can be captured when a unit is dispatched, arrives at its destination,

and at any other intermediary point during its useful life. The SSCC also serves as a critical identifier for

aggregating serial numbers when implementing track and trace. It helps to ensure that every item is uniquely

identified on the physical package and in subsequent reference documents. This supports efficiencies in shipping, receiving, and handling logistic units and their contents. Potential pitfall is Underestimating the

role of all logistics providers in being able to generate and manage SSCCs for all logistic units [7].

Batch/lot numbers correspond to a certain number of items assigned to a common group of items that were

manufactured at the same time. Batch/lot and items have a one-to-many relationship, as many items can

have the same batch/lot number. Serial numbers correspond to a unique instance of a given item; the serial

number and its item have a one-to-one relationship, allowing an entity to track and trace the item from

manufacture to dispense. However, Serialization of items is a significant investment of manufacturers and

does not provide a benefit to the supply chain unless the serial number data are used for track and trace

or verification. Ensuring stakeholders understand the complexity of the solution proposed and resources

required availing adequate infrastructures is important [7,13].

Track and trace requires that different trading partners share information about the physical movement and

status of products as they move through the supply chain from partner to partner, and ultimately to the end

user. Event data answer the questions “what, where, when, and why?” to meet reporting demands from a

range of public health stakeholders, from regulatory authorities to consumers. The GS1 Electronic Product

Code Information Services (EPCIS) standard, in conjunction with the GS1 Core Business Vocabulary

(CBV), is the global standard for event data exchange to enable disparate applications to create and share

visibility event data, within and across enterprises, according to common definitions of data values. Event

data exchange enables a complete ledger of item status, custody/ownership, and location over the lifecycle

of the item, from manufacturer to dispense. However, it overestimates the capabilities of trading partners to

scan and report for all events in scope [7].

There are a number of factors to consider when introducing serialization processes. This include the following:

(i) Consider legislative complexities; (ii) Map out your requirements; (iii) Pay attention to timeframes; (iv)

Limit your investment; (v) Consider the full drug lifecycle and (vi) Look to the future. It is important not

to forget how serialization may impact your productivity going forward. Evidence from early adopters of

serialization processes suggests that productivity, also known as overall equipment effectiveness (OEE),

can go down by as much as 10% [14]. It is extremely important to map out your internal business process

from purchase of material through to the delivery of finished goods to find out where and how serialization

will affect your operations. Patient expectation safe and high-quality drugs and manufacturers expectation

to ship their products in a secure supply chain that guarantees the custody of these medicines places

greater responsibility on distributors, re-packagers and other intermediaries in the supply chain. Creating a

tighter and closed system is required to prevent the introduction of illegitimate products, better detect the

introduction of illegitimate products, and enable stakeholders and the regulatory organizations to respond

rapidly when such products are found [14,15].

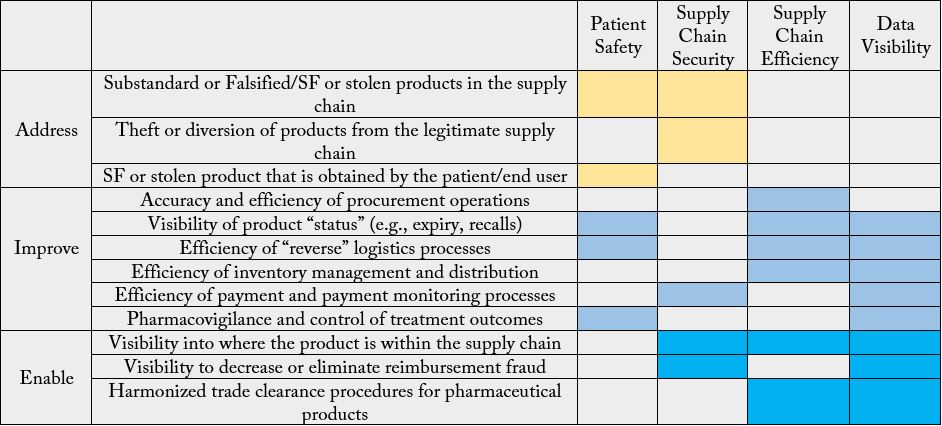

Traceability Models

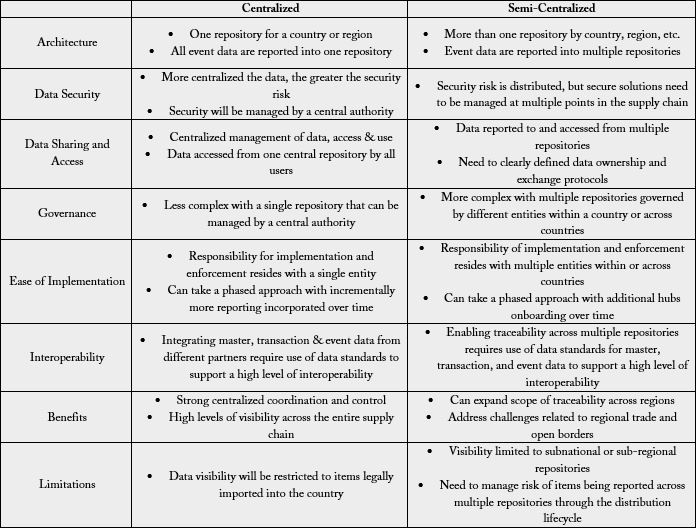

Several models for traceability in the pharmaceutical industry are currently implemented. Depending on the

specific challenges in their pharmaceutical supply chains the scope or phases of implementations worldwide

could differ. The models could be a ‘centralized, or a ‘semi-centalized’ traceability system (Table 3) [7].

Contain one centralized data repository (hub) at the country level managed by a ministry, regulatory

authority, or logistics management unit. Trading partners have to share event data with the central hub and

requires data integration with trading partners for data exchange.

Semi-centralized model contains national and sub-national hubs. The National data hub is managed by

ministry, regulatory authority, or logistics management unit. External trading partners have to share event

data with the central hub and it requires data integration with trading partners for data exchange. While

Regional-, zonal- or district level hub manage subnational event data reporting and requires data integration

with internal trading partners for data exchange.

Different approaches can be used to address regulatory needs of countries. Commonly used include;

codification (product identification by the product: GTIN + lot no.+ Expiry date); Aggregation and

serialization (Figure 4).

Steps of Serialization Implementation

Tracking and tracing system success depends on setting right strategies and implementation plans. The

country tracking and tracing company/office should have clear goals and strategies to achieve these goals

designed by involving all stakeholders having direct or indirect effect on product movement along supply

chain. The following are examples of activities that can be done before, during and after implementing the

track and tracing system in national pharmaceutical supply chain. [1] Before implementing track and trace

program: Communicate Proactively with customers, select right team to lead the program and identify

benchmarks. [2] During implementing track and trace program: Develop Strategic plan, Select Vendors and

standardize the process by using pilot program at country level [16,17].

Implementing serialization requires self-evaluation of capacity to adopt technologies and available opportunities for running the system. Here are some of steps required to implement serialization in a given country [16-19].

1. Involve all relevant stakeholders

2. Select priority areas (drugs with high risk for counterfeiting, controlled drugs etc.)

3. Conduct pilots before scaling up traceability implementation

4. What to serialize at port of entry (Bulk package, Secondary Package, Primary Package (sellable unit packaging) or individual product)

a. Bulk package/Cartoon or pallet serialization

b. Secondary package/Box serialization

c. Primary Package/Sellable unit serialization

d. Individual product/Vial, capsule, tablet Serialization

5. Serialization and traceability of unique items; Implementation of this phase will benefit the pharmaceutical supply chain because:

6. Planning data traceability/visibility goal (regulatory, National warehouse, or dispensing unit or individual patient level)

7. Regulatory requirement: some countries may require changes in existing pharmaceutical laws

8. Quality control of traceability system (Barcode, serial number quality etc.)

9. Monitoring the system performance and scale-up for next priority products

Global Standards in Low and Middle Income Settings

In recent years, drug regulatory authorities and the health care industry have been aligning on adoption of

global standards for identification, including serialization; product labeling; and data exchange to enable

pharmaceutical traceability. However, of implementing this global standard in domestic production of

low and middle income countries which are struggling with immature domestic production and lack of

access to essential medicines will have negative impact on the industry as well as on the healthcare service

delivery. This is domestic manufacturers in LLMICs often operate in capital-constrained environments

and may have a limited ability to invest in technological infrastructure to support increasing innovation.

These constraints may result in additional challenges in meeting the increasing number and stringency

of regulatory requirements, including stricter quality standards and quality control measures and, moving

forward, implementation of global standards for identification, labeling, and data exchange [20,21].

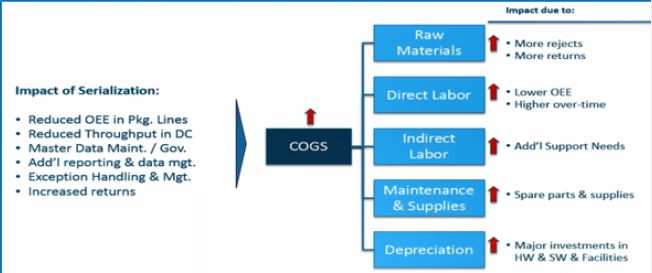

Serialization or implementing track and trace system increases the cost of final goods sold, decrease efficiency

packaging lines. This is because it increases rejection from raw material sides, reduces overall equipment

effectiveness, requires additional human resources and machines and increases depriciation (Figure 5) [6].

Track and trace is an area where skilled people are still relatively rare, and where pharmaceuticals companies

especially smaller ones are still experiencing difficulties evolving their operating models to comprise more

effective exchanges across their organization and with the partners. The following are some of major

challenges for implementation of serialization: (i) Financial, (ii) Complexity of structure; (iii) Technology

and infrastructure related; (iv) Legislative requirement related; (v) Establishing long-term relationships with vendors; (vi) Complexity of the pharmaceutical supply chain; (vii) Concern of product safety and quality;

(viii) Productivity and Cost Issues and (ix) Data Management Challenges [22].

Serialization affects every aspect of the pharmaceutical business: proper implementation uses up resources

and the impact on an organization should be fully assessed. Not only regulatory offices, supply chain

management, engineering and IT systems, but also project management, operations, quality, internal training,

packaging and artwork/marketing departments are involved in the process. The creation of a dedicated

working group with representatives from all these different areas has proven successful in the deployment

phase. Capital investments include the costs associated with acquiring the equipment and technologies for

implementation. These represent a one-time investment that can be amortized over time, with expectation

of recovery through earnings and costs savings over several years. These costs vary depending on the desired

capabilities (more complex requirements often require more sophisticated technologies) and the scale of the

solution (e.g., manufacturers with more production lines will require more scanners than those with fewer

production lines) [23].

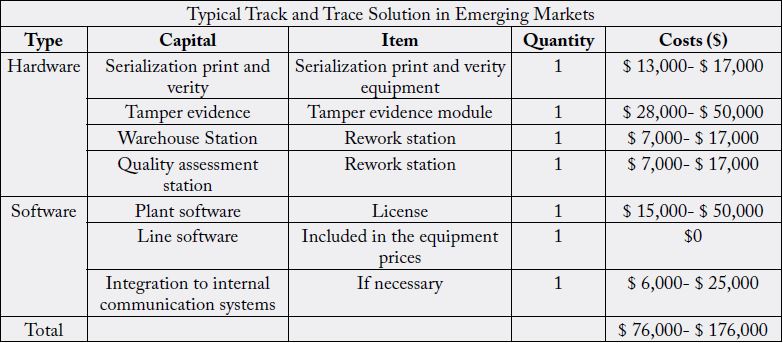

A rough estimate of overall, the European Generics Association (EGA) estimates the cost to comply with the EU’s serialization regulations as: Printing and serialization around US $331,000 to $397,000 (approximately €303,000 to €364,000) per packaging line; Anti-tampering around US $199,000 to $265,000 (approximately €183,000 to €243,000) per packaging line, and Verification with repository information systems around $53 million (approximately €49,000,000) per year [24]. For a rough estimate of the equipment and software costs involved in a traceability implementation in developing countries requires in average $126,000 USD ranging from ($76,000-176,000). This cost doesn’t include GS1 registration, engineering costs required for hardware installation, training and education, downtime, Annual GS1 licensing fee and maintenance (Table 4) [23,25].

Manufacturers will require additional investment in systems and technology to meet emerging mandates for product identification, labeling, and data exchange. Systems will need to have the capability to generate, manage, and share key data elements, and interfaces will need to be developed to share that data with national traceability systems. The investment required will depend on the scope and requirements of the implementation. For example, the capabilities required to print and manage serialization data are much more sophisticated than those required for GTIN, batch/lot, and expiry date. Similarly, the capabilities required for printing directly on the pack are more advanced than those required to print and place a sticker label. Additional investments (e.g., barcode printers and scanners) will be necessary to print and test barcoded product labels [3,5,26].

Failing to consider the needs of domestic manufacturers during the development of a global standards

implementation timeline can put them at risk of non-compliance and reduce their ability to compete in the

marketplace. In many cases, domestic manufacturers work with less capital and more manual processes than

their global counterparts. As such, they may not be able to respond to new regulations and requirements

with the same speed as multinational manufacturers. Domestic manufacturers may then fail to become

compliant, which places their business at risk [23].

Globally, there is consensus regarding which standards are needed to secure the supply chain namely, the

inclusion of a product’s GTIN, batch/lot, expiry, and serial number. However, there is a risk that countries,

in their implementation, will fail to harmonize fully with this global consensus. For example, countries may

seek to build in additional requirements beyond globally used standards. This deviation from the global use

of GS1 standards effectively creates a parallel or proprietary requirement for a specific market, increasing

both costs and lead times. When those additional requirements are country-specific, they can also hinder the

manufacturer’s ability to supply that product across borders [23].

Countries that require proprietary solutions as part of their traceability implementations may increase

the cost of manufacturing and reduce flexibility in the ability of manufacturers to supply their markets.

This can also pose a risk to commodity security, in particular for countries with relatively small markets,

which run an increased risk of manufacturers withdrawing from commerce. Domestic manufacturers are

disproportionately affected by proprietary solutions, which can pose significant technical challenges and

hinder their capacity to supply to global markets [27].

Implementation of global standards, processes, systems, and technology for traceability can be complex,

especially around governance and management of master, transaction, serialization, and event data. Manufacturers will develop new capabilities within their existing workforce and in some cases, hire additional

experts for assistance during their transition. Thus education and capabilities development is imperative for

before implementation of the GS1 standards [23,28-31].

Conclusion

Aligning around a single set of global standards can support processes and capabilities that create value for

all participants in a supply chain, from business partners down to the patients. A serialization investment

can deliver numerous benefits for stakeholders including; Enhancing Supply chain data visibility; Increasing

patient safety; Ensuring supply chain security and control; Increasing supply chain efficiencies and Improving

trade and business across borders.

As track and trace system works with principle ‘one size may not fit for all’, it is important for countries to consider their priority areas and capacities to implement tracking and tracing system. Specially implementing global GS1 standard by domestic producers in LMICs should be evaluated carefully due to resource constraint, Lack of expertise, shortage of access to essential drugs, capacity of domestic producers to export their products and affordability of essential medicines.

Countries from LMIC settings should evaluate their capacity (technology adaptation of end users, expertise to install and maintain; financial capacity for start-up and annual licensing fees) and pilot the project if deemed necessary on priority areas before implementing the global standards in their immature industries. It is also important to understand that serialization is an investment in which software developers may urge the governments to establish this system for sake of promoting their business. Some of countries in Africa including Ethiopia are currently supported by USAID to start global GS1 standard in some program products like products used for HIV/AIDS and Malaria. It is better to think twice in such scenarios before scaling this program to other services, due to questionable sustainability of donor support and internal capacity to sustain the system.

In business there is always conspiracy of developing virus and anti-virus programs. Smugglers and counterfeiters have capacity to challenge any system (both technically and financially) in any society; Therefore, it is worth to improve the countries border control and national drug quality control laboratory capacity with advanced equipments to deal with this complex problem.

Finally, serialization is not ultimate solution for supply chain security and product safety and developing countries should empower their regulatory system for their domestic production and designing their own supply chain visibility system to address the imported products based on their own capacity than struggling with global serialization system is imperative.

Bibliography

Hi!

We're here to answer your questions!

Send us a message via Whatsapp, and we'll reply the moment we're available!